The following is the key chat information, which has important reference significance for other Indian customers

we promise that all the products you bought have technical services. If you have to get the flame treatment technology before you agree to start the cooperation, so,you don't have to change the supplier.

Make sure agents will only use the original commercial invoice while shipping the material...on air way bill...ur company details and my company details should only be there...

Because in my experience...agents use fake invoices or lower invoice value...some other companies details to ship the material

order Process will be :-

1.Signed and stamped p.i.

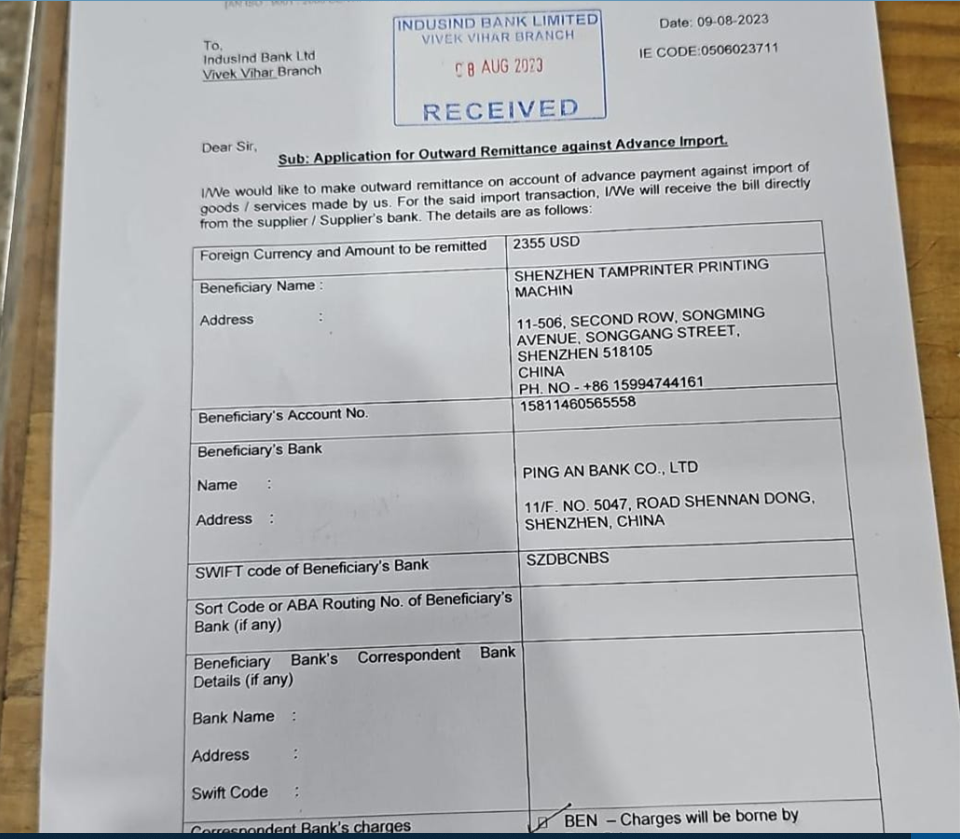

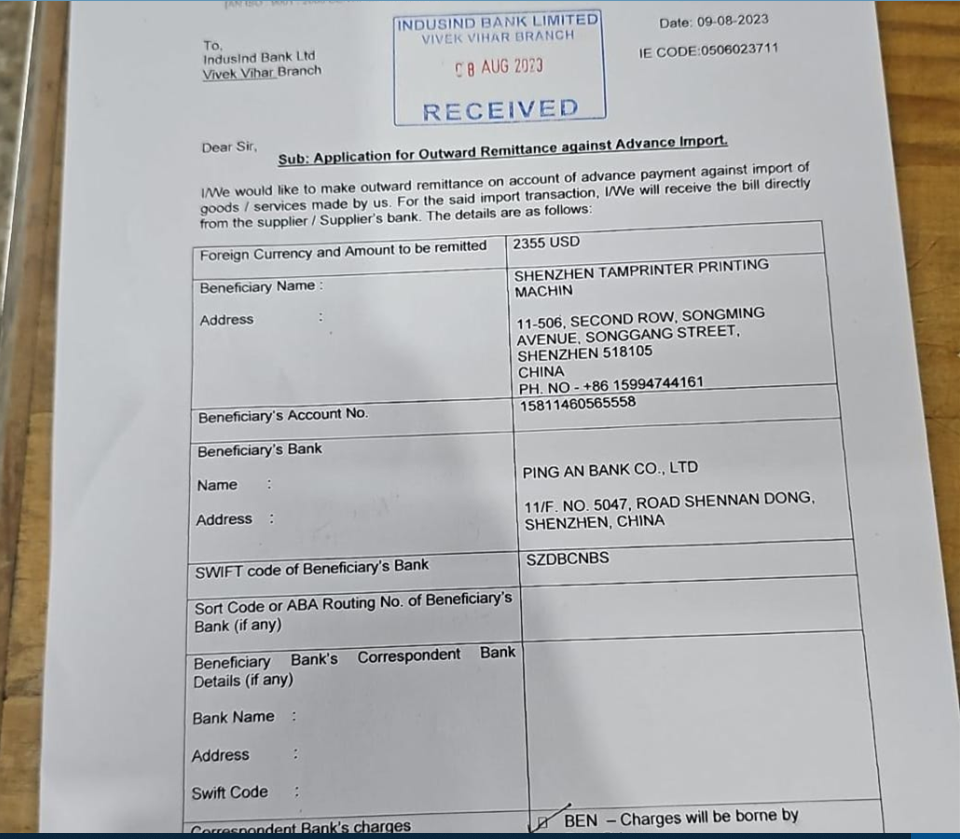

2. I will do a bank payment and i will send you a swift message.

3. You pack the material and share me images.

4. I will tell you the description of the commercial invoice.

5. After booking the shipment...you share my air way bill for checking and approval.

6. After approval of the commercial invoice and airway bill you can hand over the box to fedex.

Q:

Is a certificate of origin required? Mutual tax incentives for the Asia-Pacific region,For tax deduction

FORM B The first title is TAMPRINTER, and the document fee is $50.

The second title is TAMPRINTER, the file fee is $15

choose 50 or15?ask your agent?

A:

I dnt want to save any tax....because if i try to do something...theindian government will cancel my iec and will freeze my bank account...it happens to many suppliers.

you first time do business with tamprinter ,if direect send money to our Shenzhen company based account ,will add $150 cost ,next time no this cost,Hongkong bank no need do such a complicated process

China's foreign exchange bureau defines India as a foreign exchange risk country and needs to go through the anti-money laundering review process

Unknown customers must go through this process for the first time, and must formally declare for export and get all the documents before they can do foreign exchange verification

International relations determine the transaction threshold. For the same export, there is a minimum difference of 90 US dollars between customs declaration from Shenzhen and customs declaration from Hong Kong, and there are complicated documents.

Considering we've worked together many times, no one would mind the $150

I suggest that as long as your total purchase amount exceeds 8,000 US dollars, you can deduct the 150 US dollars

What do you think of this initial cost? this order does not have enough profit to cover this cost, if still no agree, which means that this effort still cannot reach a cooperation, unfortunately